Rumored Buzz on Top 30 Forex Brokers

Rumored Buzz on Top 30 Forex Brokers

Blog Article

Indicators on Top 30 Forex Brokers You Need To Know

Table of ContentsExamine This Report about Top 30 Forex BrokersAbout Top 30 Forex BrokersExcitement About Top 30 Forex BrokersAbout Top 30 Forex Brokers5 Simple Techniques For Top 30 Forex BrokersThe smart Trick of Top 30 Forex Brokers That Nobody is Talking AboutTop 30 Forex Brokers Fundamentals Explained

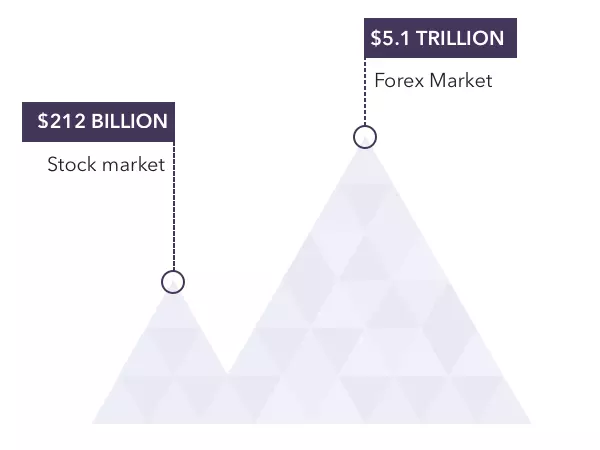

Forex is the largest and most liquid market in the globe. A profession as a forex trader can be profitable, versatile, and extremely appealing. There is a steep discovering contour and forex investors encounter high dangers, leverage, and volatility.

There are numerous benefits that a profession as a forex trader, additionally known as a foreign exchange trader, uses. They consist of: Foreign exchange trading can have really inexpensive (brokerage and compensations). There are no compensations in a real sensemost forex brokers make earnings from the spreads between forex money. One does not need to bother with consisting of separate brokerage firm charges, eliminating overhanging costs.

Not known Details About Top 30 Forex Brokers

The foreign exchange markets run all the time, making it possible for professions at one's ease, which is very advantageous to short-term investors who have a tendency to take settings over brief periods (state a few minutes to a couple of hours). Few traders make trades during complete off-hours. Australia's daytime is the nighttime for the East Coast of the United state

business hoursService as little development is expected and anticipated are rates a stable range during array off-hours for AUD. Such investors adopt high-volume, low-profit trading strategies, as they have little profit margins because of an absence of growths specific to forex markets. Instead, they try to make revenues on reasonably steady low volatility duration and make up with high volume professions.

Foreign exchange trading is extremely accommodating in this means. Compared with any various other monetary market, the foreign exchange market has the biggest notional worth of day-to-day trading. This supplies the highest degree of liquidity, which means also large orders of money professions are quickly filled successfully without any kind of big cost variances. This eliminates the possibility of rate adjustment and cost abnormalities, thereby making it possible for tighter spreads that result in more reliable pricing.

Unless significant events are anticipated, one can observe comparable cost patterns (of high, mid, or low volatility) throughout the non-stop trading.

The Buzz on Top 30 Forex Brokers

Such a decentralized and (relatively) deregulated market helps stay clear of any kind of sudden surprises. Contrast that to equity markets, where a firm can instantly declare a reward or report substantial losses, bring about massive rate modifications. This reduced level of law also aids keep prices low. Orders are straight placed with the broker that performs them by themselves.

The significant currencies often display high cost swings. If professions are positioned intelligently, high volatility assists in enormous profit-making chances. There are 28 major money pairs involving 8 major money. Standards for selecting a set can be convenient timing, volatility patterns, or economic developments. A foreign exchange trader that enjoys volatility can conveniently switch from one money set to one more.

Top 30 Forex Brokers Fundamentals Explained

Without even more capital, it might not be possible to trade in other markets (like equity, futures, or alternatives). Availability of margin trading with a high leverage element (up to 50-to-1) comes as the icing on the cake for forex trades. While trading on such high margins comes with its very own threats, it likewise makes it simpler to get much better profit potential with minimal resources.

It is still often subject to market control. In significance, there are great deals of advantages to forex trading as a job, yet there are downsides.

Top 30 Forex Brokers Fundamentals Explained

Being broker-driven methods that the foreign exchange market may not be fully transparent. A trader may not have any type of control over exactly how his trade order gets satisfied, might not obtain the ideal price, or may get minimal sights on trading quotes as provided just read what he said by his chosen broker. A straightforward solution is to deal just with managed brokers who fall within the purview of broker regulators.

Foreign exchange rates are affected by several elements, mostly international politics or economics that can be difficult to analyze information and draw trustworthy verdicts to trade on., which is the key factor for the high volatility in foreign exchange markets.

Top 30 Forex Brokers Fundamentals Explained

Forex investors are completely on their very own with little or no help. Disciplined and continual self-directed knowing is a should throughout the trading profession. Most novices quit during the first phase, largely due to the fact that of losses endured due to limited forex trading knowledge and incorrect trading. Without control over macroeconomic and geopolitical growths, one can easily suffer massive losses in the very unstable forex market.

Report this page